Budget Planning

A budget plan is like a roadmap for your money that helps you decide how to spend and save wisely. 💰

Brief Introduction

Budget planning is similar to packing for a long trip - you need to know what resources you have and plan how to use them wisely. Just as you wouldn't start a road trip without checking your fuel and planning your stops, budget planning helps you manage your money by tracking income and planning expenses. It's a practical tool that helps prevent financial stress and helps you reach your money goals. 🎯

Main Explanation

Income Tracking 📈

It's like checking how much water is flowing into a bucket. First, add up all money coming in from your job, side activities, or investments. For example, if you earn $3,000 monthly from your job and $200 from online selling, your total income is $3,200.

Expense Categories 📋

Think of it like sorting your groceries into different bags. Group your spending into categories like housing, food, transport, and fun. For instance, your monthly categories might include $1,000 for rent, $400 for groceries, $200 for gas, and $150 for entertainment.

Savings Goals 🏦

It's like filling up a piggy bank before buying toys. Always set aside money for future needs and wants before spending on non-essentials. Example: saving $300 monthly for emergencies and $200 for a future vacation.

Regular Review ✅

Like checking your fitness progress, regularly compare your actual spending with your plan. If you planned $400 for groceries but spent $500, you'll know to adjust next month.

Examples

- Sarah wants to buy a $600 phone in 6 months. She creates a budget plan, identifies she can save $100 monthly by reducing dining out, and reaches her goal without debt. 📱

- A family of four tracks their monthly spending and discovers they're spending $200 on unused streaming services. They adjust their budget, cancel unnecessary subscriptions, and redirect that money to their vacation fund. 🏖️

- A college student uses a simple budget plan to divide his $1,000 monthly allowance: $500 for rent, $200 for food, $100 for transport, $100 for books, and $100 for savings. This helps him avoid running out of money before month-end. 🎓

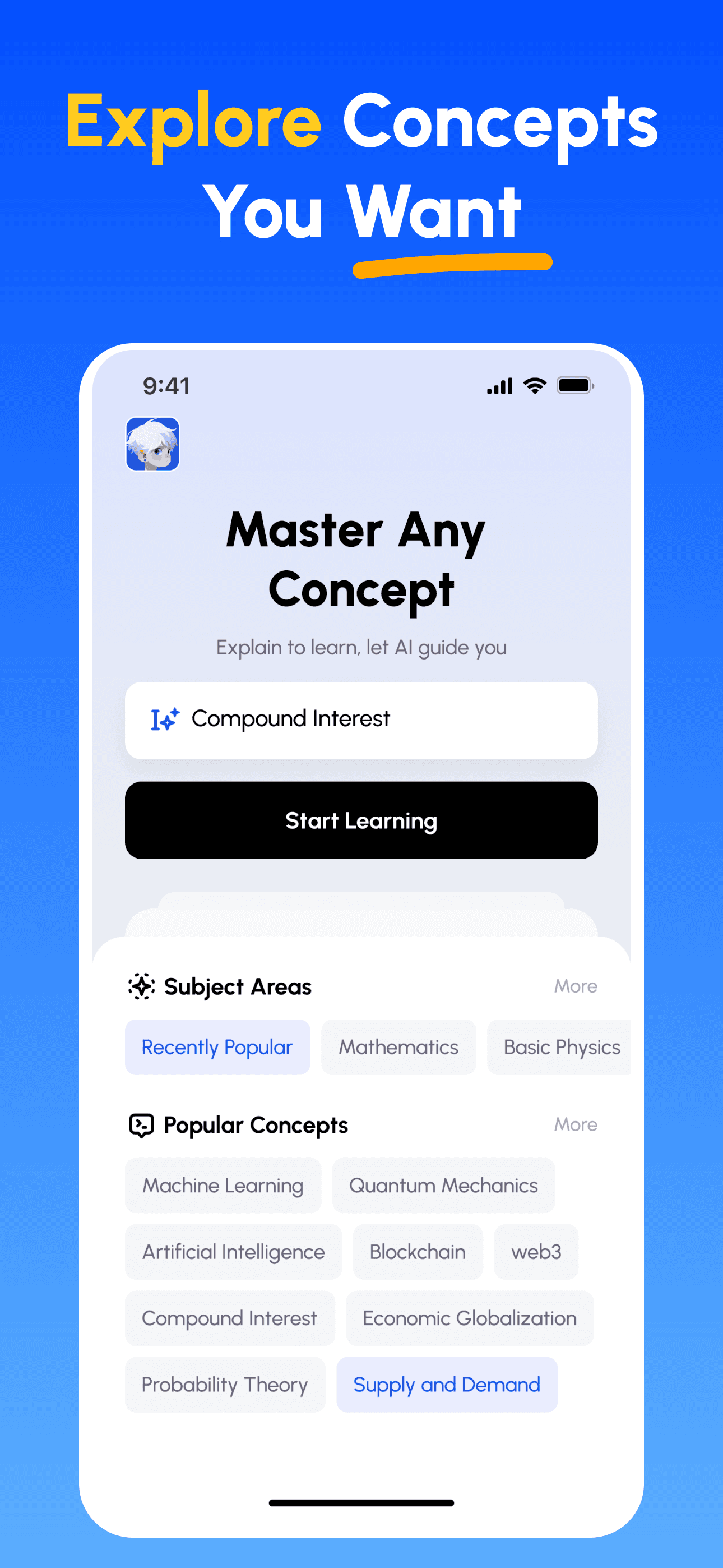

How Feynman AI Guides Your Learning

- Choose Any Concept: Start from a topic you want to master — browse curated subjects or enter your own.

- Learn Essentials: Skim clear, structured explanations, key terms and common pitfalls to form a solid mental model.

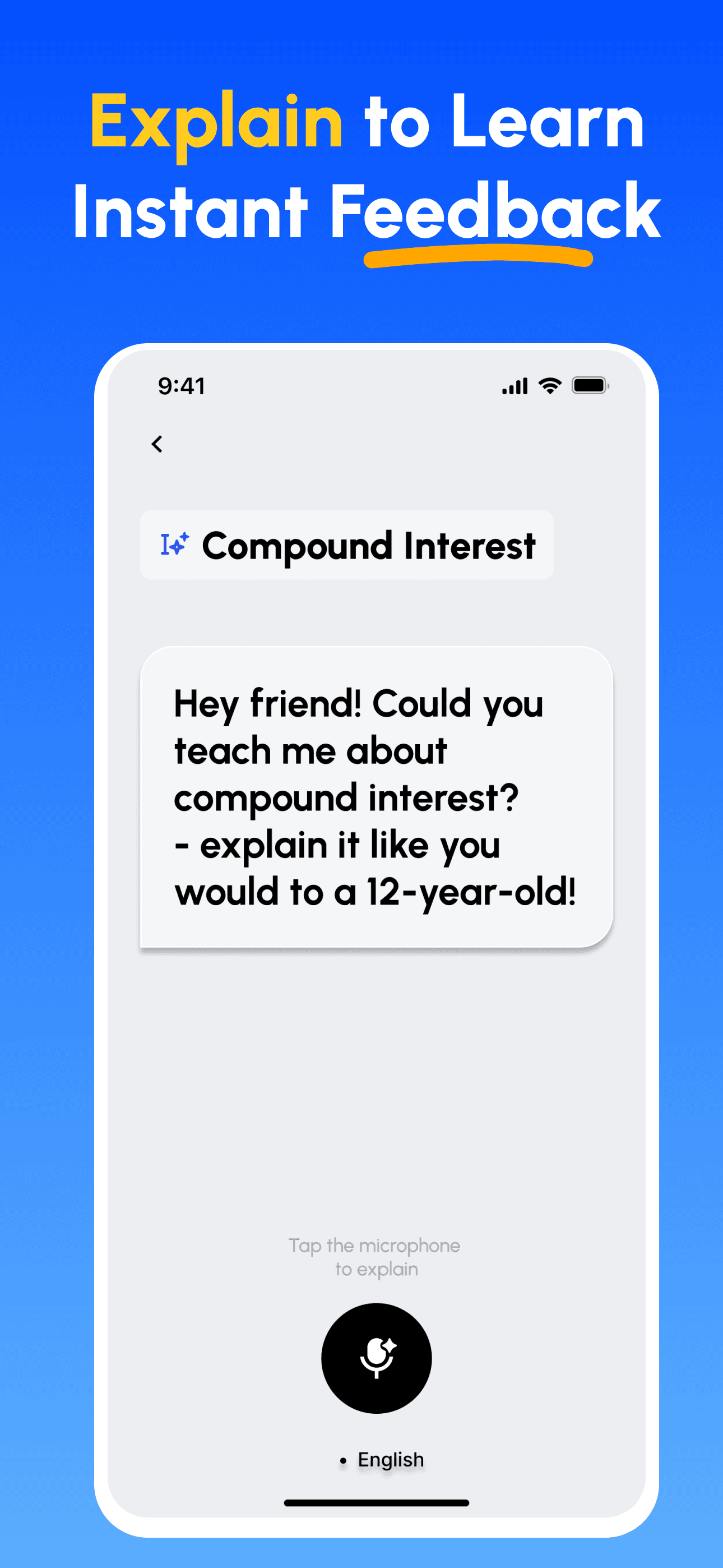

- Explain & Get Feedback: Record your explanation (voice or text). Get instant analysis on depth, clarity, structure and example quality.

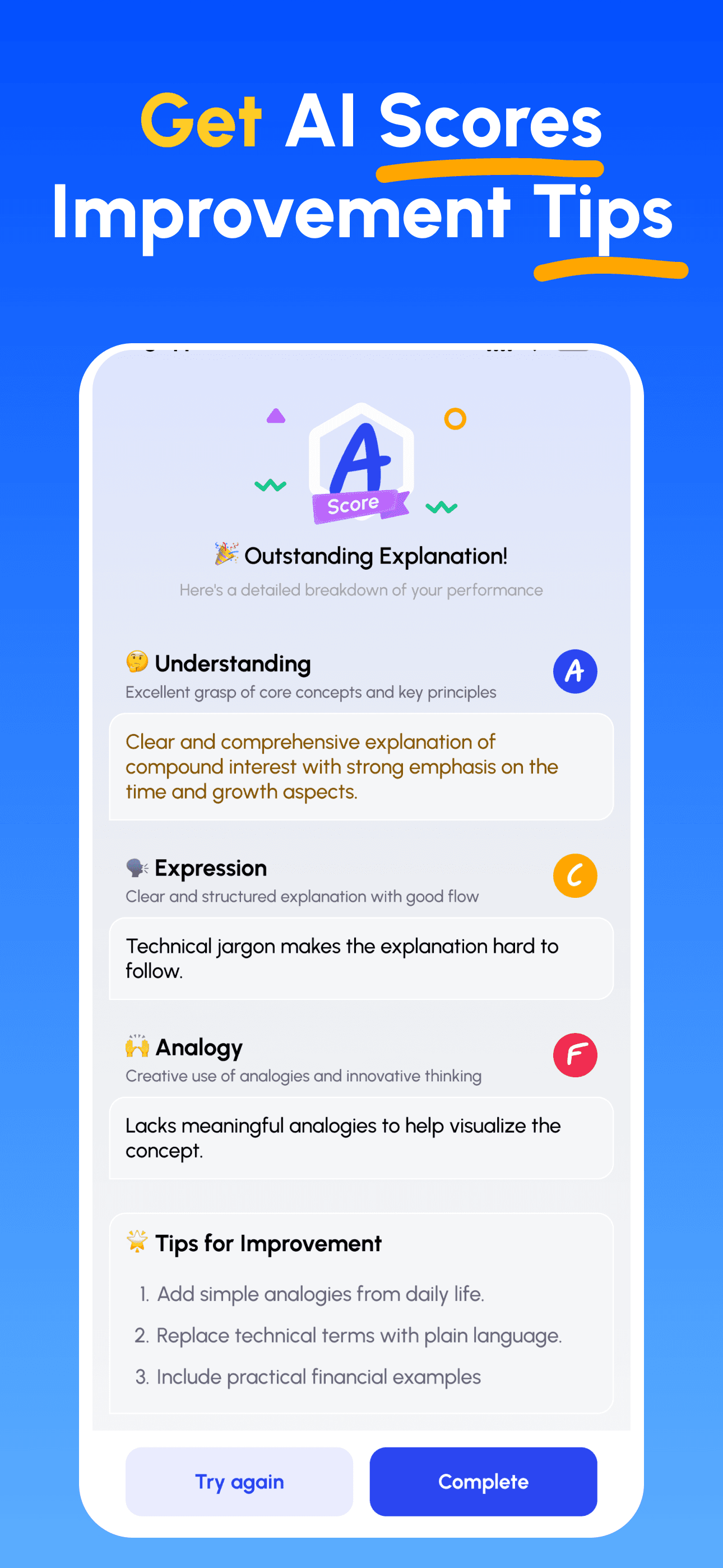

- Review Scores & Improve: Follow targeted tips, refine your explanation and iterate until you can teach it simply.

Download Feynman AI Now

Start your learning journey today!