Saving and Interest

Saving money and earning interest is like planting a seed that grows into more money over time 🌱

Brief Introduction

Saving and interest work together to help your money grow. When you keep money in a bank instead of spending it, the bank pays you extra money (interest) for letting them use your savings. It's similar to lending a friend your bicycle, and they thank you by giving you a small reward each month for using it. 🏦

Main Explanation

Basic Savings 💰

When you put money in a savings account, you're storing it safely while earning a small reward. For example, if you save $100, and the bank offers 2% interest per year, you'll have $102 after one year just by keeping your money there.

Compound Interest ⚡

Interest can earn more interest - like a snowball getting bigger as it rolls. If you leave that $102 in the bank for another year at 2% interest, you'll earn interest not just on your original $100, but also on the $2 you earned before.

Time Effect ⏰

The longer you save, the more your money grows. It's like planting a tree - at first, growth seems slow, but over many years, it becomes much bigger. $1000 saved at age 20 could become much more by age 60 thanks to compound interest.

Different Types of Savings 📊

Just like different plants need different care, there are various ways to save: regular savings accounts (like a garden), fixed deposits (like a greenhouse), and investment accounts (like a farm). Each offers different interest rates and access to your money.

Examples

- Sarah saves $10 weekly from her allowance in a piggy bank. After learning about interest, she opens a savings account. Now her money grows by itself - after a year, her $520 savings became $530 with interest! 🐷

- Think of compound interest like a pizza-making business. You start with one pizza shop earning money, then use those earnings to open a second shop. Now both shops earn money, letting you open a third shop faster! 🍕

- Miguel's grandmother gave him $100 when he was 10. His parents helped him put it in a savings account with 5% interest. By his 18th birthday, without adding any more money, it grew to about $147 just from interest! 🎁

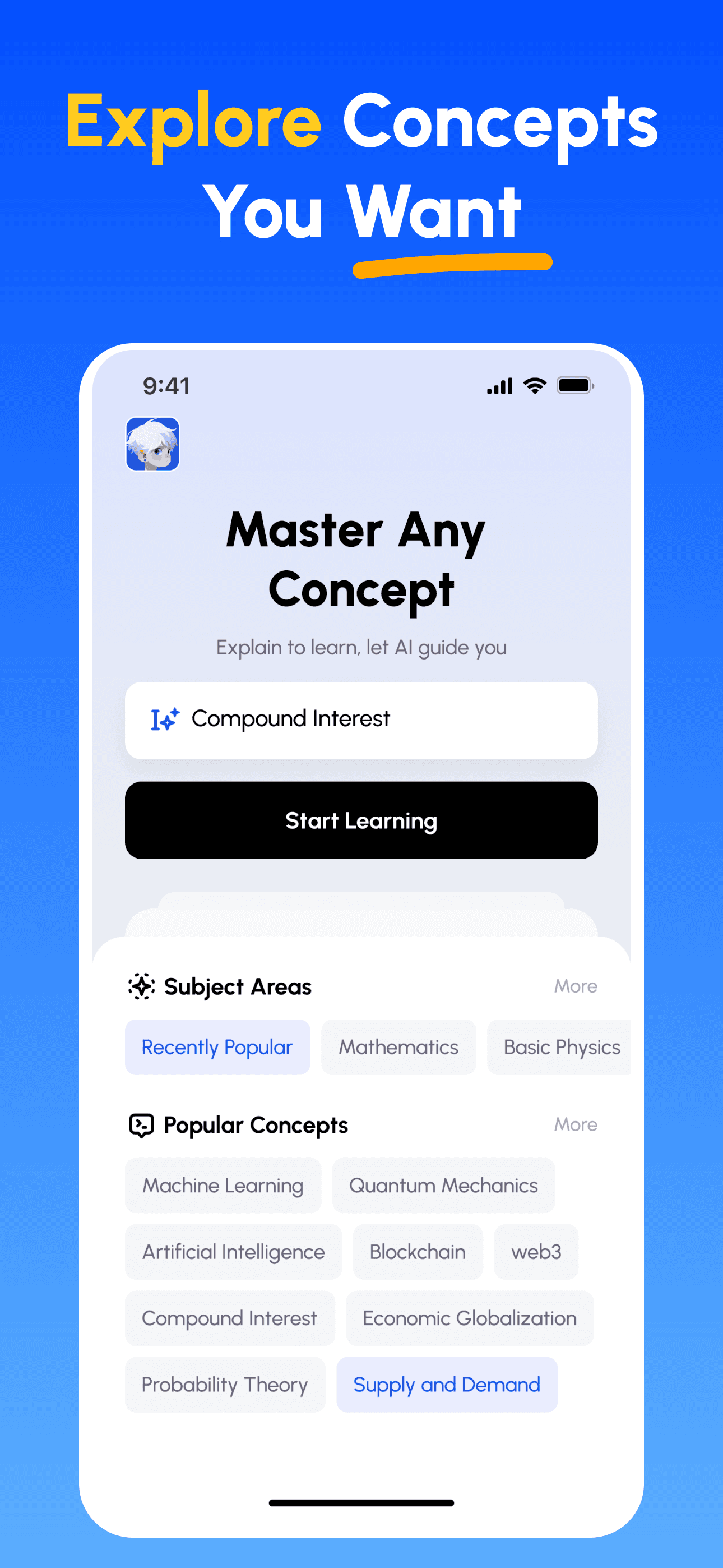

How Feynman AI Guides Your Learning

- Choose Any Concept: Start from a topic you want to master — browse curated subjects or enter your own.

- Learn Essentials: Skim clear, structured explanations, key terms and common pitfalls to form a solid mental model.

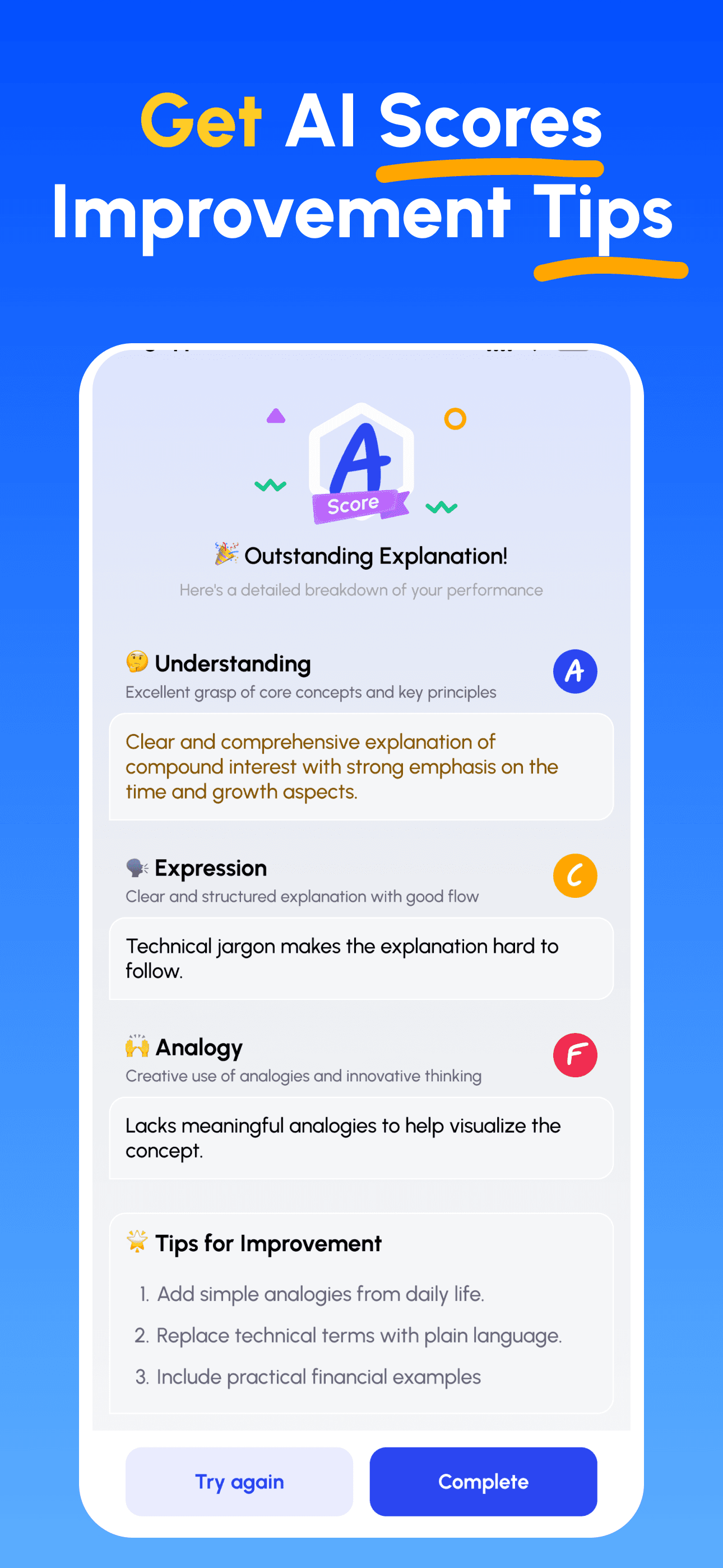

- Explain & Get Feedback: Record your explanation (voice or text). Get instant analysis on depth, clarity, structure and example quality.

- Review Scores & Improve: Follow targeted tips, refine your explanation and iterate until you can teach it simply.

Download Feynman AI Now

Start your learning journey today!