Money Functions

Money is a tool that helps people buy things, save for later, and measure the worth of different items.

Brief Introduction

Money is like the oil that keeps society's engine running smoothly. Without it, we'd have to trade items directly (like trading chickens for shoes), which would be very difficult and time-consuming. Money solves this by providing a common way for everyone to exchange goods and services easily. 💰

Main Explanation

Medium of Exchange 🔄

It's like a universal ticket that everyone accepts. Instead of finding someone who wants exactly what you have to trade, money lets you buy what you need from anyone. For example, a baker can sell bread for money, then use that money to buy shoes, without needing to find a shoemaker who specifically wants bread.

Store of Value 🏦

Money acts like a battery that stores value for future use. It's like saving energy for a rainy day. Instead of storing 100 apples that might rot, you can keep money that maintains its value and use it when needed.

Unit of Account 📏

Money works like a measuring tape for value. Just as we use inches to measure length, we use money to measure and compare the value of different things. It helps us know if a car is worth more than a bicycle, and by how much.

Standard of Deferred Payment ⏳

It's like a promise for the future. When you borrow money, both you and the lender know exactly what needs to be paid back later. This makes loans and credit possible.

Examples

- Imagine going to a grocery store with a chicken to pay for your groceries - it would be chaos! Money makes it simple: you just hand over some cash or swipe a card. 🛒

- When your grandmother wants to give you a birthday gift that you can use later, she gives you money instead of perishable cake - the value stays intact until you need it. 🎁

- When comparing prices between a coffee ($3) and a sandwich ($6), money helps you instantly understand that the sandwich costs twice as much as the coffee. ☕️

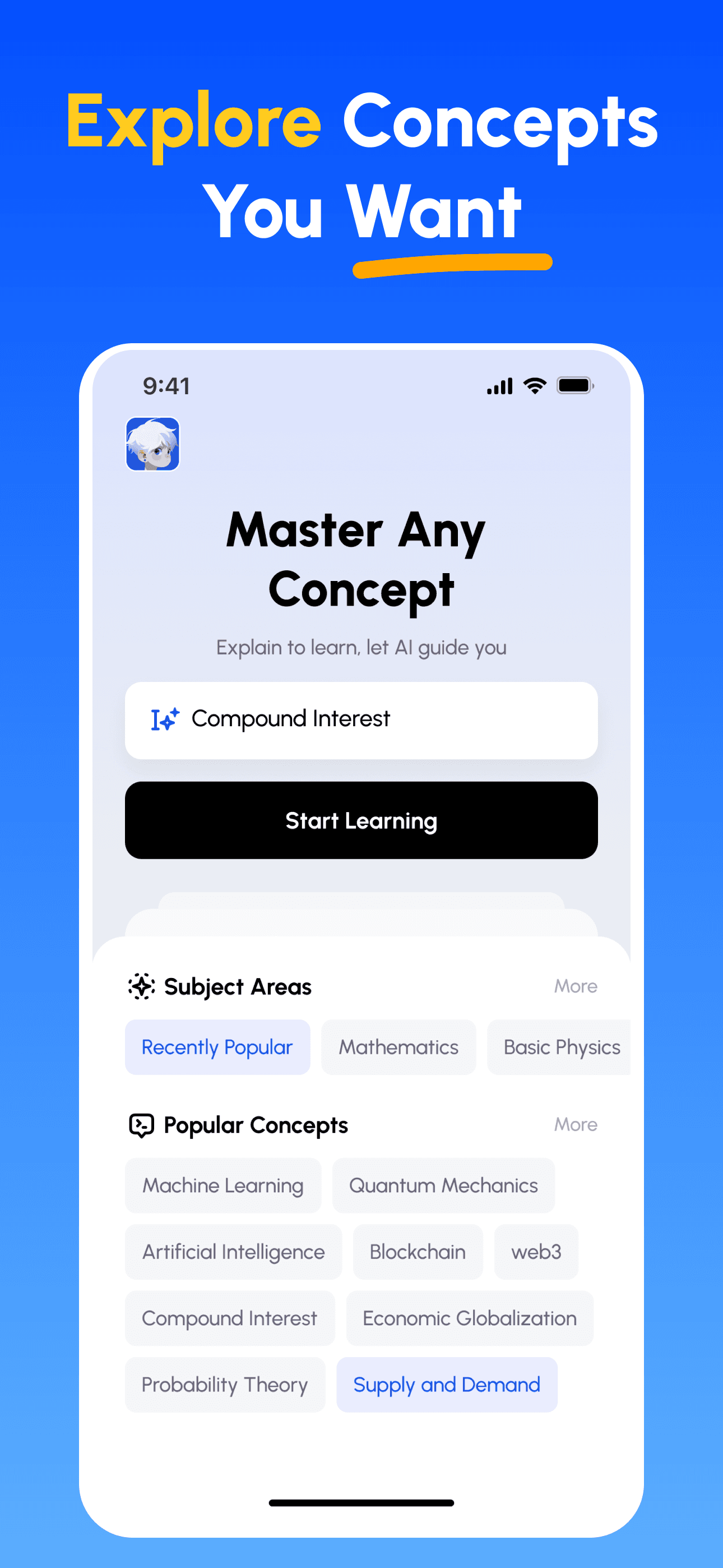

How Feynman AI Guides Your Learning

- Choose Any Concept: Start from a topic you want to master — browse curated subjects or enter your own.

- Learn Essentials: Skim clear, structured explanations, key terms and common pitfalls to form a solid mental model.

- Explain & Get Feedback: Record your explanation (voice or text). Get instant analysis on depth, clarity, structure and example quality.

- Review Scores & Improve: Follow targeted tips, refine your explanation and iterate until you can teach it simply.

Download Feynman AI Now

Start your learning journey today!